How to Start Forex Trading on Octa MT4/ MT5 Desktop

This article will introduce you to the MetaTrader 4/5 platform, developed for online trading in the Forex market. The platform provides tools for technical analysis, as well as placing and managing trades. We'll explain the platform's interface and teach you how to manage a trade.

How to Start Forex Trading

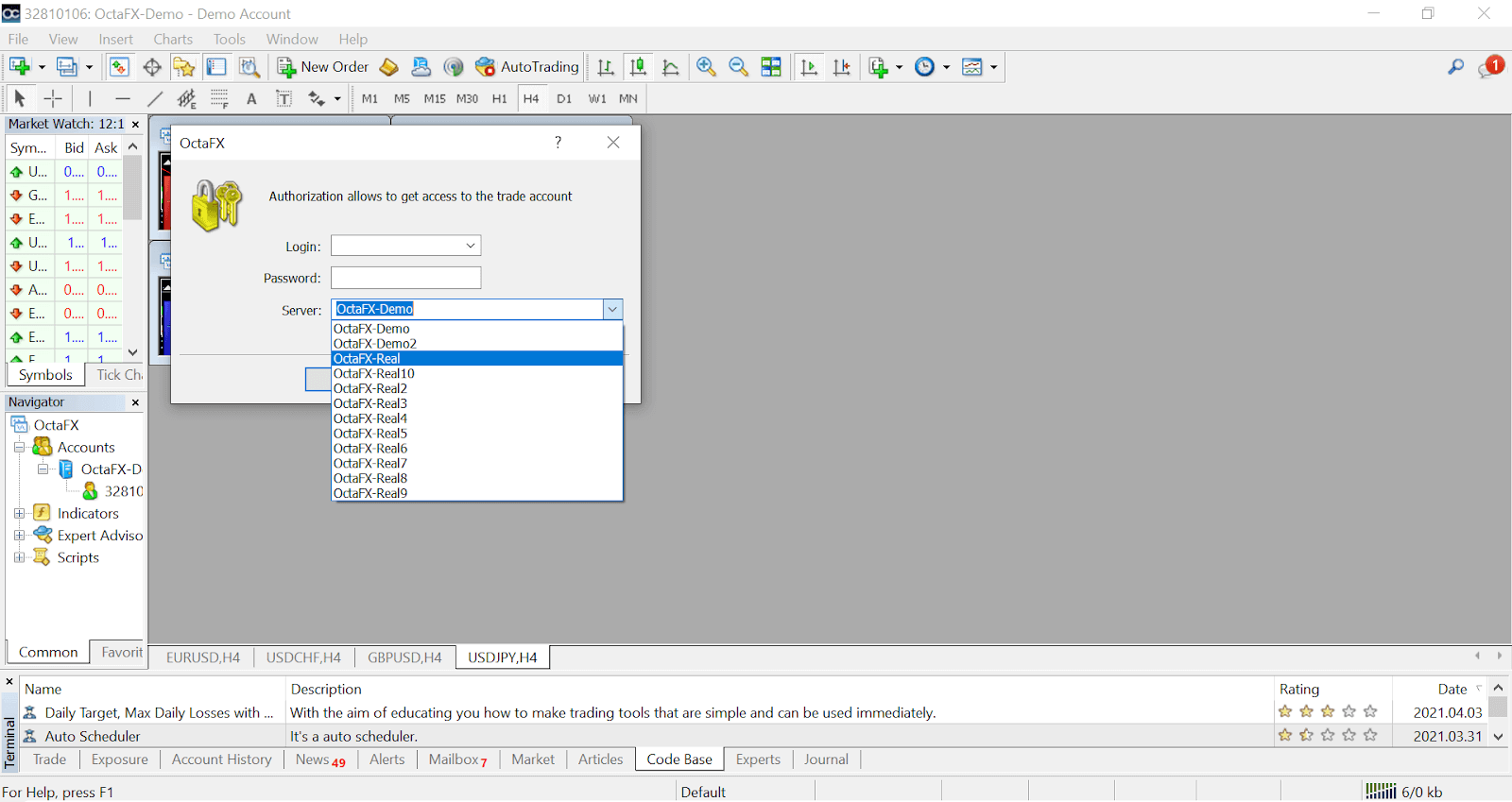

1. Once you open the application, youll see a login form, which you need to complete using your login and password. Choose the Real server to log into your real account and the Demo server for your demo account.

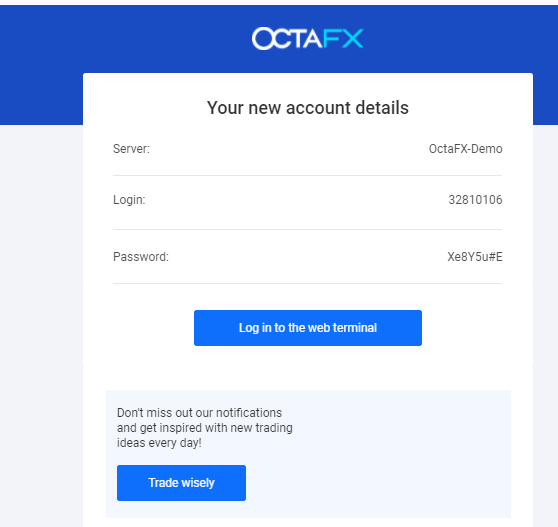

2. Please note that every time you open a new account, well send you an email containing that accounts login (account number) and password.

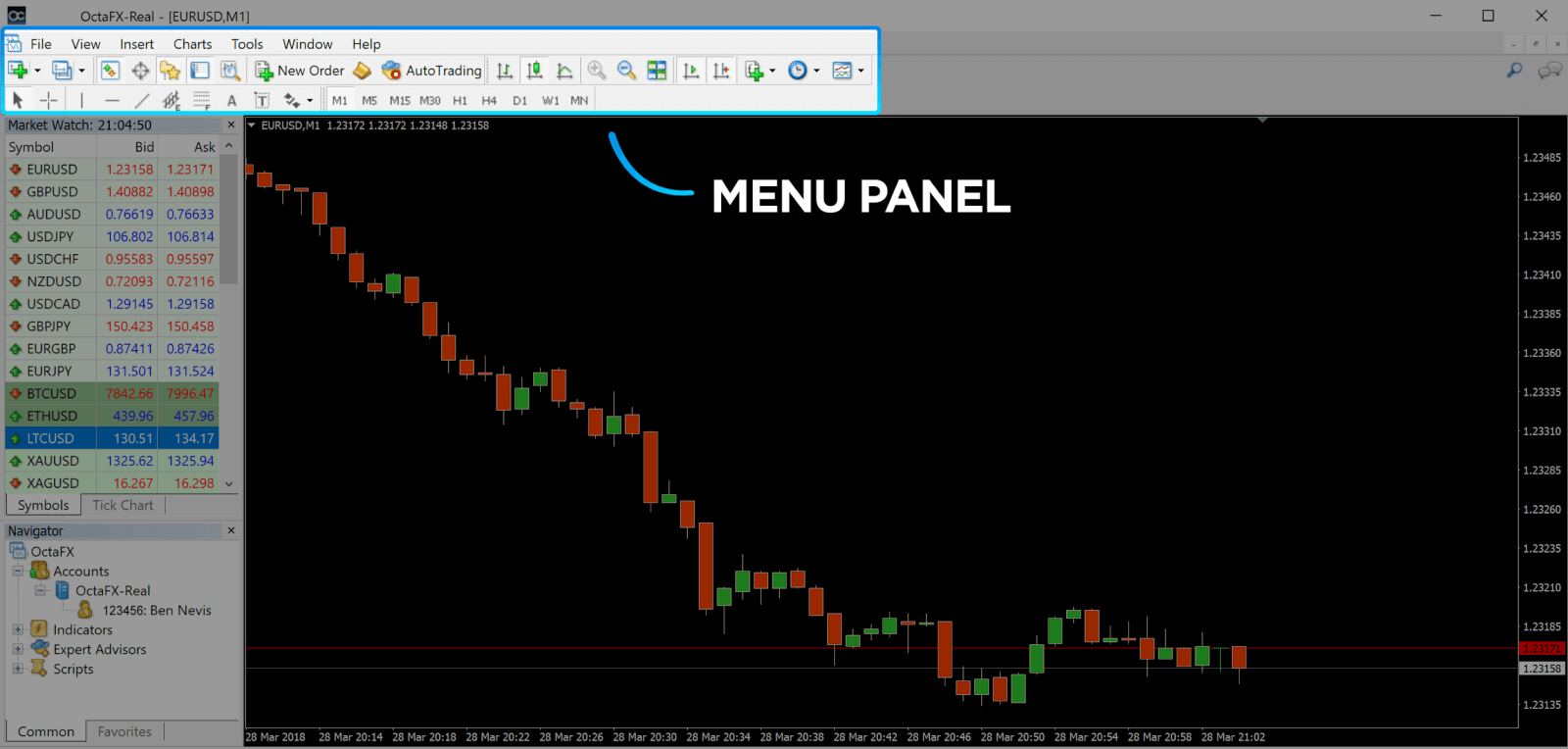

After logging in, youll be redirected to the MetaTrader platform. Youll see a big chart representing a particular currency pair.

3. At the top of the screen, youll find a menu and a toolbar. Use the toolbar to create an order, change time frames and access indicators.

MetaTrader 4 Menu Panel

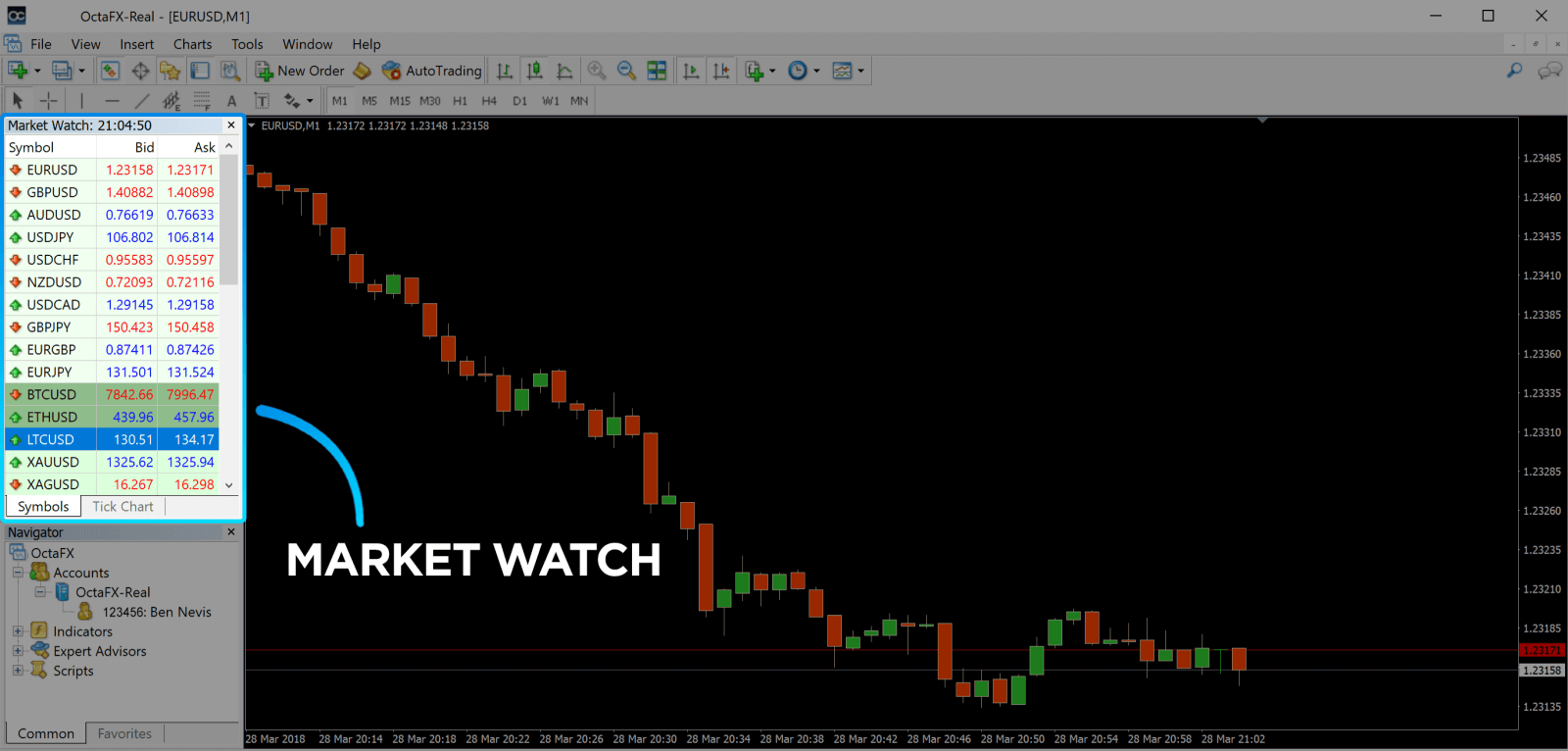

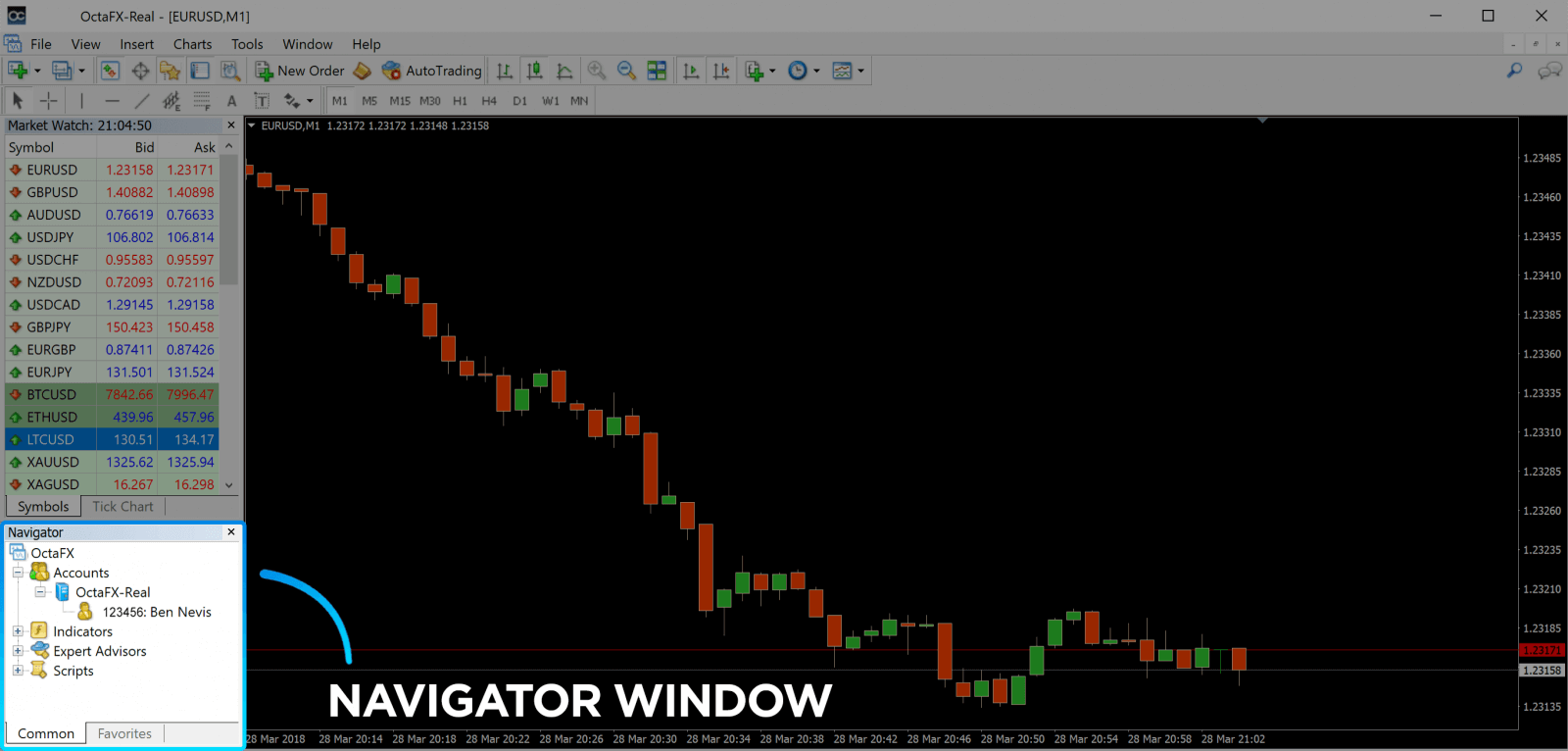

4. Market Watch can be found on the left side, which lists different currency pairs with their bid and ask prices.

5. The ask price is used to buy a currency, and the bid is for selling. Below the ask price, youll see the Navigator, where you can manage your accounts and add indicators, expert advisors, and scripts.

MetaTrader Navigator

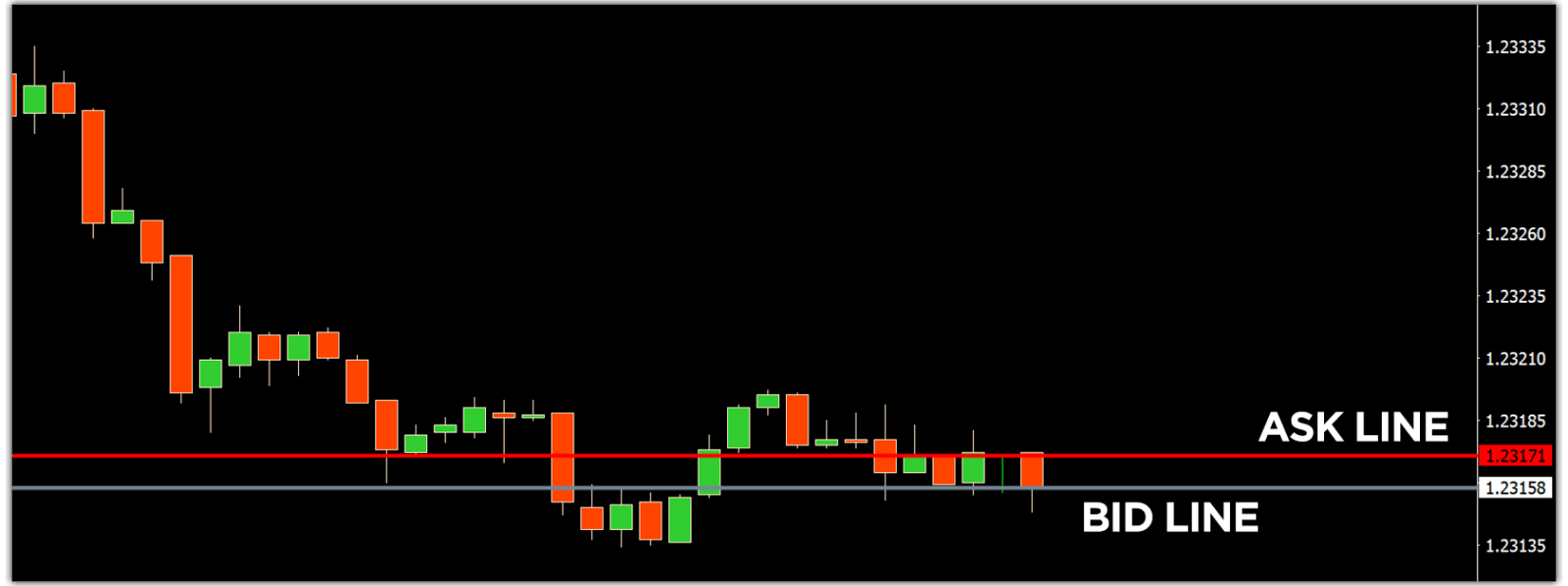

MetaTrader 4 Navigator for ask and bid lines

6. At the bottom of the screen can be found the Terminal, which has several tabs to help you keep track of the most recent activities, including Trade, Account History, Alerts, Mailbox, Experts, Journal, and so forth. For instance, you can see your opened orders in the Trade tab, including the symbol, trade entry price, stop loss levels, take profit levels, closing price, and profit or loss. The Account History tab collects data from activities that have happened, including closed orders.

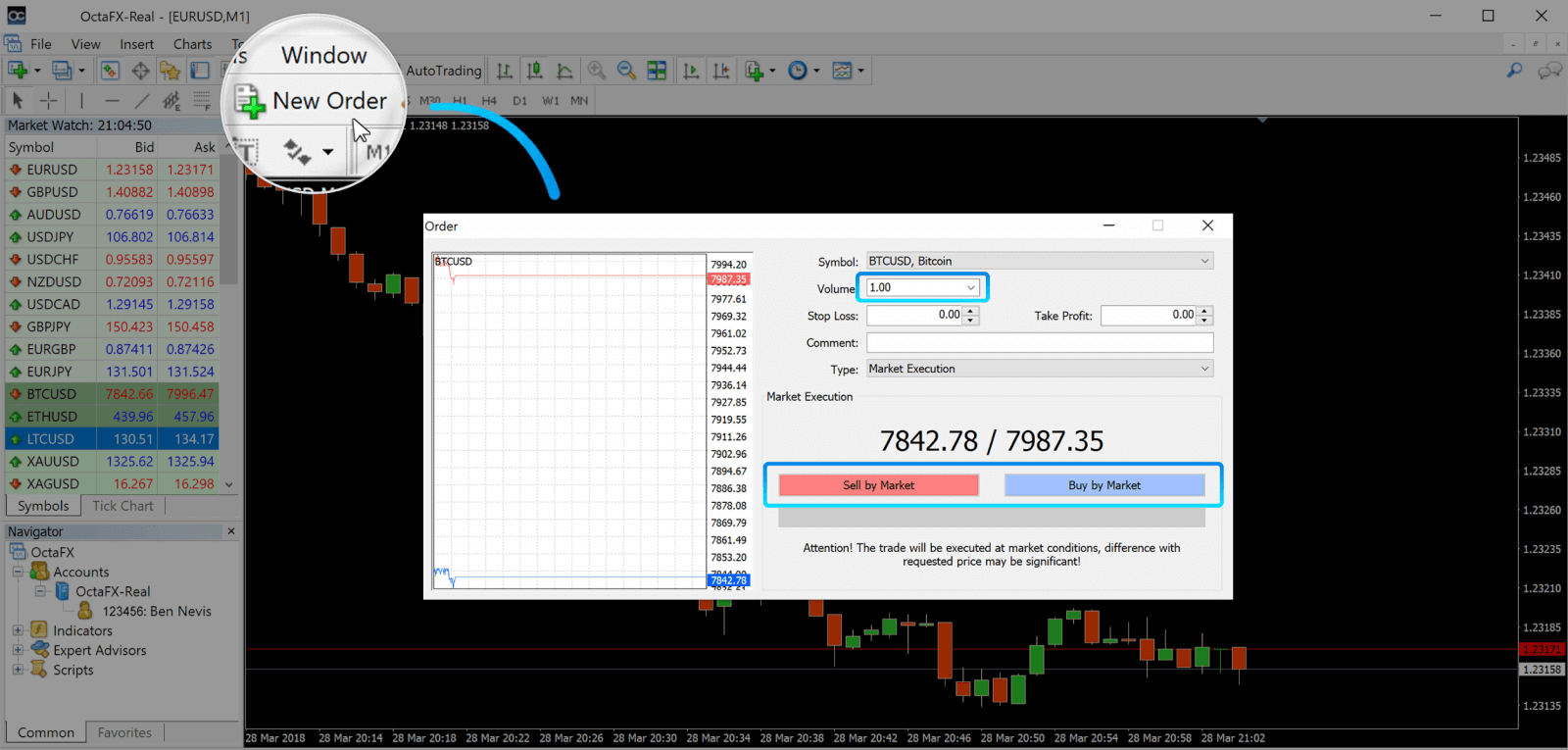

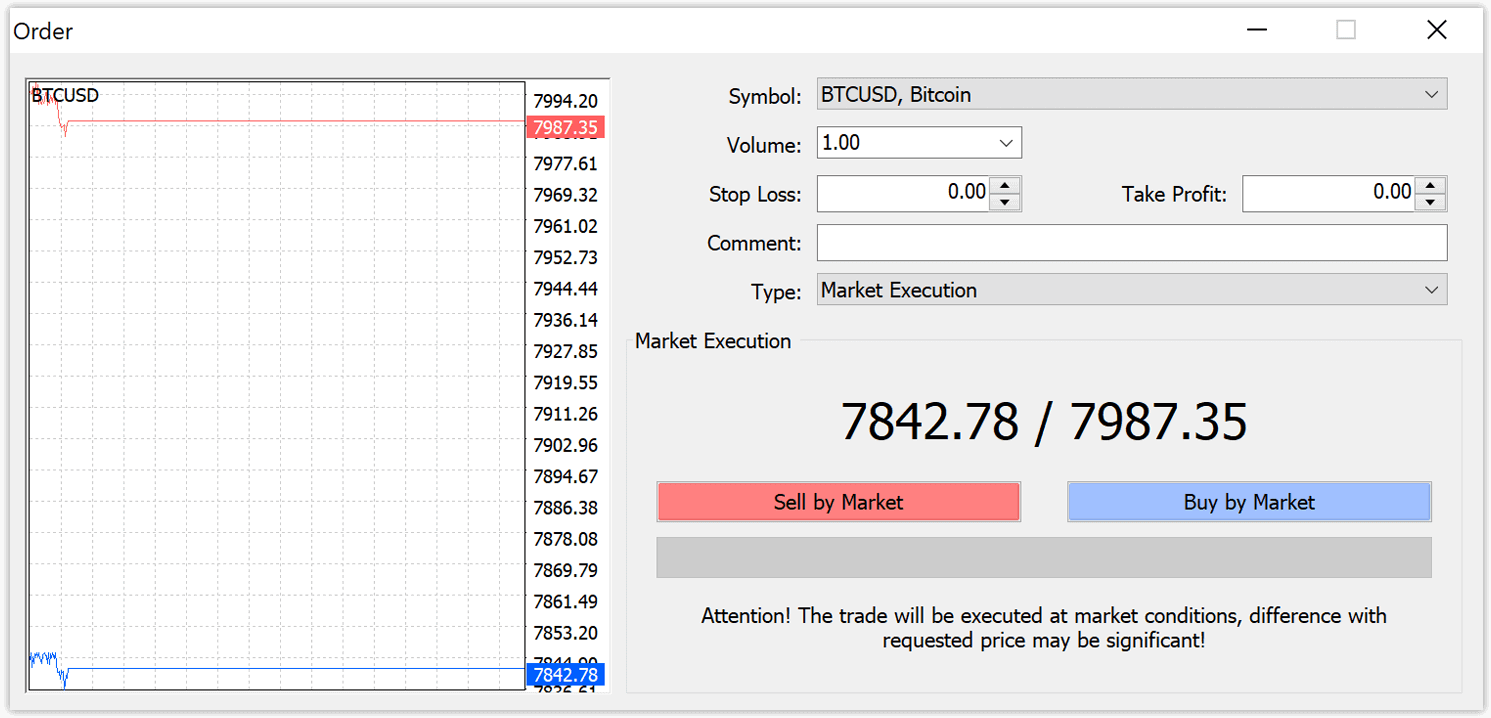

7. The chart window indicates the current state of the market and the ask and bid lines. To open an order, you need to press the New Order button in the toolbar or press the Market Watch pair and select New Order.

In the window that opens, you’ll see:

- Symbol, automatically set to the trading asset presented on the chart. To choose another asset, you need to select one from the drop-down list. Learn more about Forex trading sessions.

- Volume, which represents the lot size. 1.0 is equal to 1 lot or 100,000 units—profit Calculator from Octa.

- You can set Stop Loss and Take Profit at once or modify the trade later.

- The type of order can be either Market Execution (a market order) or Pending Order, where the trader can specify the desired entry price.

- To open a trade you need to click on either the Sell by Market or Buy by Market buttons.

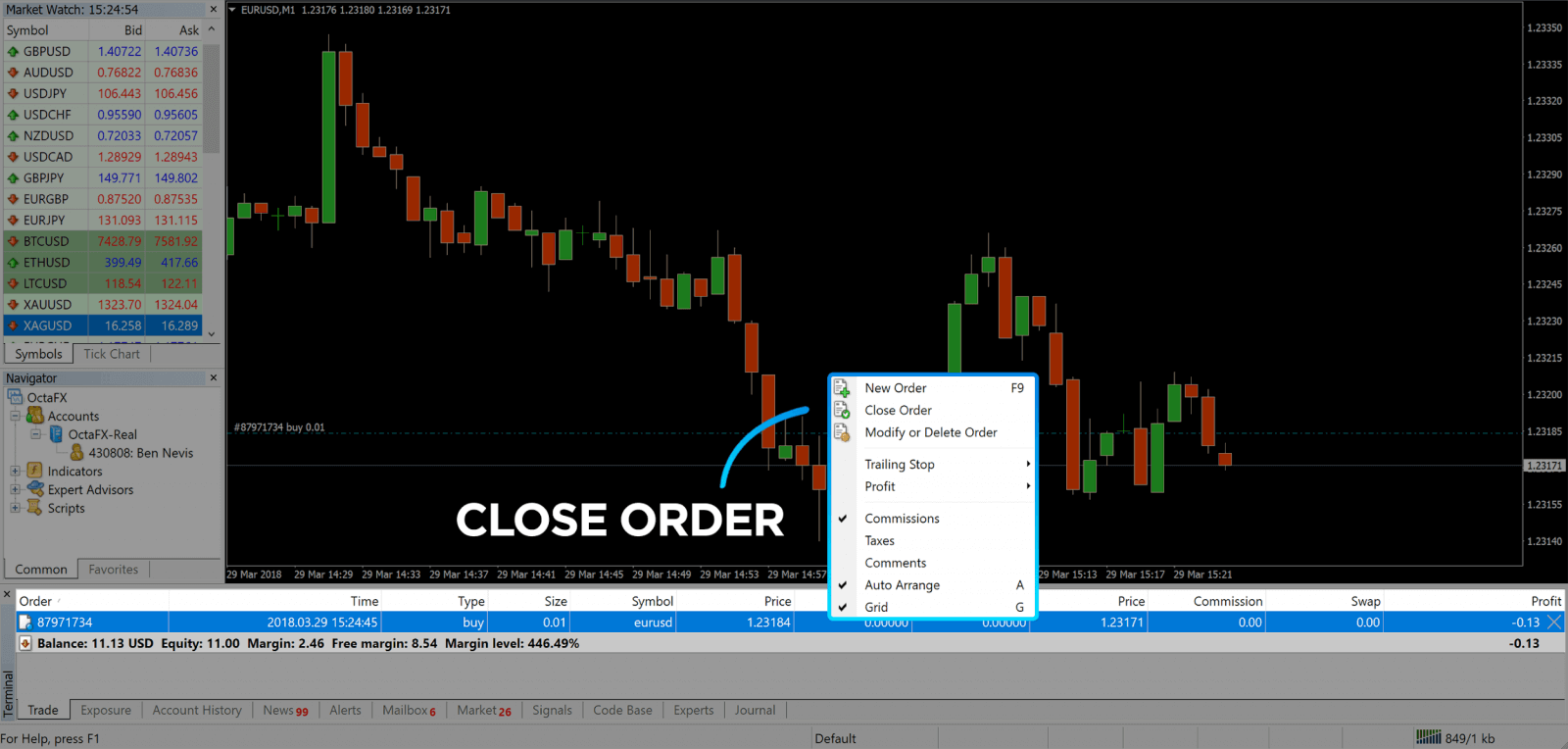

- Buy orders open by the ask price (red line) and close by the bid price (blue line). Traders buy for less and want to sell for more. Sell orders open by the bid price and close by the ask price. You sell for more and want to buy for less. You can view the opened order in the Terminal window by pressing on the Trade tab. To close the order, you need to press the order and select Close Order. You can view your closed orders under the Account History tab.

This way, you can open a trade on MetaTrader 4. Once you know each buttons purpose, itll be easy for you to trade on the platform. MetaTrader 4 offers you plenty of technical analysis tools that help you trade like an expert on the Forex market.

FAQ of Octa Trading

What is your spread? Do you offer fixed spread?

Octa offers floating spreads that vary according to the market situation. Our goal is to provide you transparent prices and the tightest spreads we can without applying any additional commission. Octa simply passes on the best bid/ask price we receive from our liquidity pool and our spread accurately reflects what is available in the market. The main advantage of a floating spread over a fixed spread is that it is often lower than average, however you may expect it to widen at market open, during rollover at (server time), during major news releases or high volatility periods. We also provide excellent fixed spreads on USD-based pairs, which offer predictable costs and are ideal for long-term investment planning. You can check minimum, typical and current spreads for all trading instruments on our Spreads and conditions page.

How does floating spread change throughout the day?

Floating spread varies throughout the day depending the trading session, liquidity and volatility. It tends to be less tight at market opening on Monday, when high impact news is released, and at other times of high volatility.

Do you have requotes?

No, we do not. A requote occurs when the dealer on the other side of the trade sets an execution delay during which the price changes. As a non-dealing desk broker Octa simply offsets all orders with the liquidity providers to be executed at their end.

Do you have slippage on your platforms?

Slippage is a slight execution price movement that may occur due to the lack of liquidity behind the requested price or when its been taken by other traders orders. It can also happen due to market gaps. Slippage should be factored in as one of the risks when trading with an ECN broker since it cannot guarantee that your order will be executed at the requested price. However, our system is set up to fill orders at the next best available price whenever slippage occurs. Please be aware that slippage can be both positive and negative, and Octa cannot influence this factor.

Do you guarantee stop orders?

Being an ECN broker, Octa cannot guarantee filling at the requested rate. After being triggered, a pending order becomes a market one and is filled at the best available price, which primarily depends on the market conditions, available liquidity, trading pattern and volume.

Is it possible to lose more than I deposited? What if my accounts balance becomes negative?

No, Octa offers negative balance protection, so whenever your balance becomes negative we automatically adjust it to zero.

Negative balance protection

Octas top priority is making your trading experience great, that’s why no matter what the risks are, we’ll back you up: Our risk management system ensures that the client cannot lose more than he initially invested.If your balance becomes negative due to Stop Out, Octa will compensate the amount and bring your account balance back to zero. Octa guarantees that your risk is limited to only those funds you have deposited into your account. Please be aware that this does not include any debt payments from the client. Thus our clients are protected from losses beyond the initial deposit at Octas cost. You can read more in our Customer agreement.

How much margin is required to open my order?

It depends on the currency pair, volume and account leverage. You can use our Trading Calculator to calculate your required margin. When you open a hedge (locked or opposite) position, no additional margin will be required, however if your free margin is negative you will not be able to open a hedge order.

My order was not executed correctly. What should I do?

With market execution we cannot guarantee filling at the requested rate for all of your positions (please check About ECN trading for more details). However in case you have any doubts, or if you would like an individual review of your orders, you are always welcome to write a detailed complaint and send it to [email protected]. Our trade compliance department will investigate your case, provide you with a prompt response and make corrections to the account if applicable.

Do you have any commissions?

MT4 and MT5 commission is included in our spreads as mark-up. No additional fee is applied. We charge trading commission on cTrader. View half-turn commission rates

What trading techniques and strategies can I use?

Our clients are welcome to use any trading strategies, including but not limited to scalping, hedging, news trading, martingale as well as any Expert Advisers, with the only exception being arbitrage.

Do you allow hedging/scalping/news trading?

Octa allows scalping, hedging and other strategies, if the orders are placed in accordance with our Customer Agreement. However please note that arbitrage trading is not allowed.What tools do you have for me to track major news releases and times of high market volatility?

Please feel free to use our Economic Calendar to be informed about upcoming releases, and our Forex News page to learn more about recent market events. You can expect high market volatility when the event with top priority is about to take place.

What is a price gap and how does it affect my orders?

A price gap signifies the following:

- Current bid price is higher than the ask price of the previous quote;

- or Current ask price is lower than the bid of the previous quote

- If your Stop Loss is within the price gap, the order will be closed by the first price after the gap.

- If the pending order price and Take Profit level are within the price gap, the order will be cancelled.

- If the Take Profit order price is within the price gap, the order will be executed by its price.

- Buy Stop and Sell Stop pending orders will be executed by the first price after the price gap. Buy Limit and Sell Limit pending orders will be executed by the order’s price.

For example: bid is listed as 1.09004 and ask is 1.0900. In the next tick, bid is 1.09012 and ask is 1.0902:

- If your Sell order has stop loss level at 1.09005, the order will be closed at 1.0902.

- If your Take Profit level is 1.09005, the order will be closed at 1.0900.

- If your Buy Stop order price is 1.09002 with take profit at 1.09022, the order will be cancelled.

- If your Buy Stop price is 1.09005, the order will be opened at 1.0902.

- If your Buy Limit price is 1.09005, the order will be opened at 1.0900.