How to Trade Crypto in Octa

How to Trade Crypto

Cryptocurrency Trading is easier with Octa.

If you have any interest in trading and investment, it would be hard not to look into cryptocurrency trading. Cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and many others have excited investors with the possibility of substantial profits and a completely new way of thinking about what a currency is and how it works.

To start trading cryptocurrencies with us, follow these simple steps:

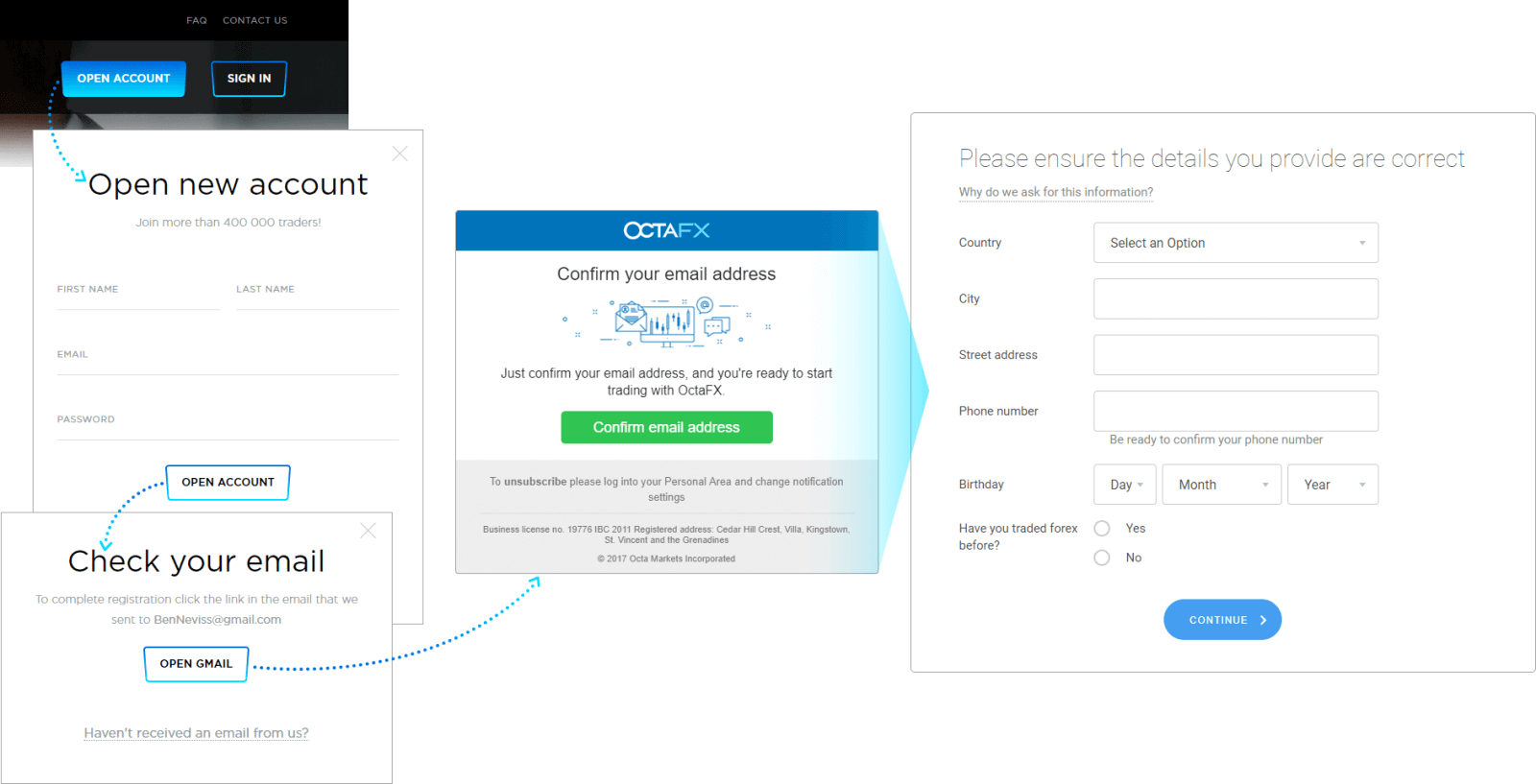

Step1: Creat a Profile

Sign up on our site, confirm your email address, and start a trading account. In some cases, you may also need to complete the verification process.

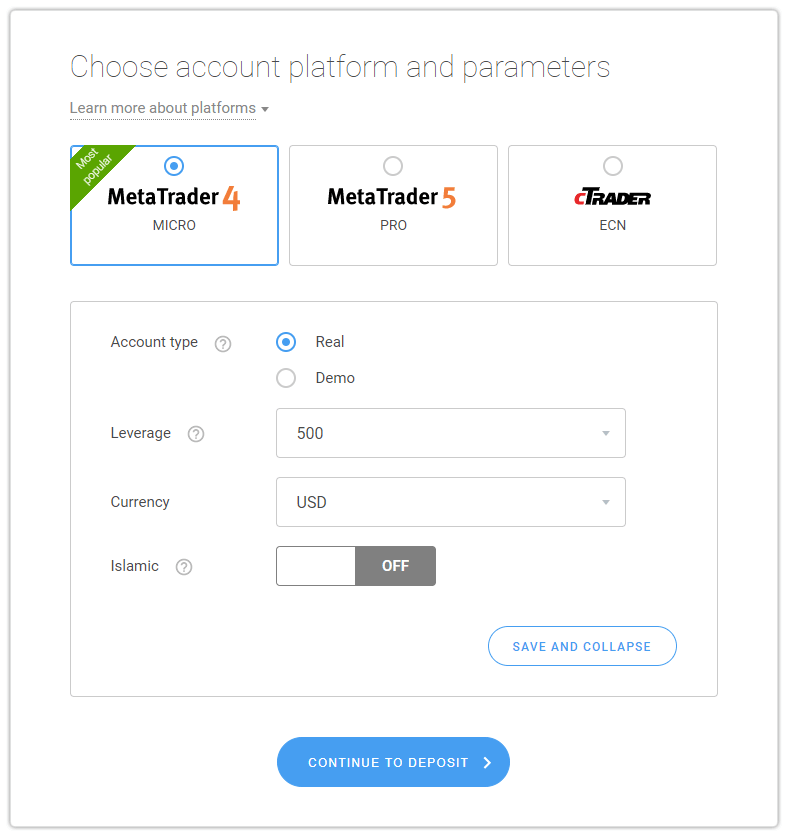

Step2: Choose the Platform

Choose whether you want to use the MetaTrader 4 or MetaTrader 5 platform to trade. MetaTrader 4 is the long-established and arguably the best standard for pure Forex trading, while MetaTrader 5 allows you to better set up your trading preferences. Research both and see which suits you best.

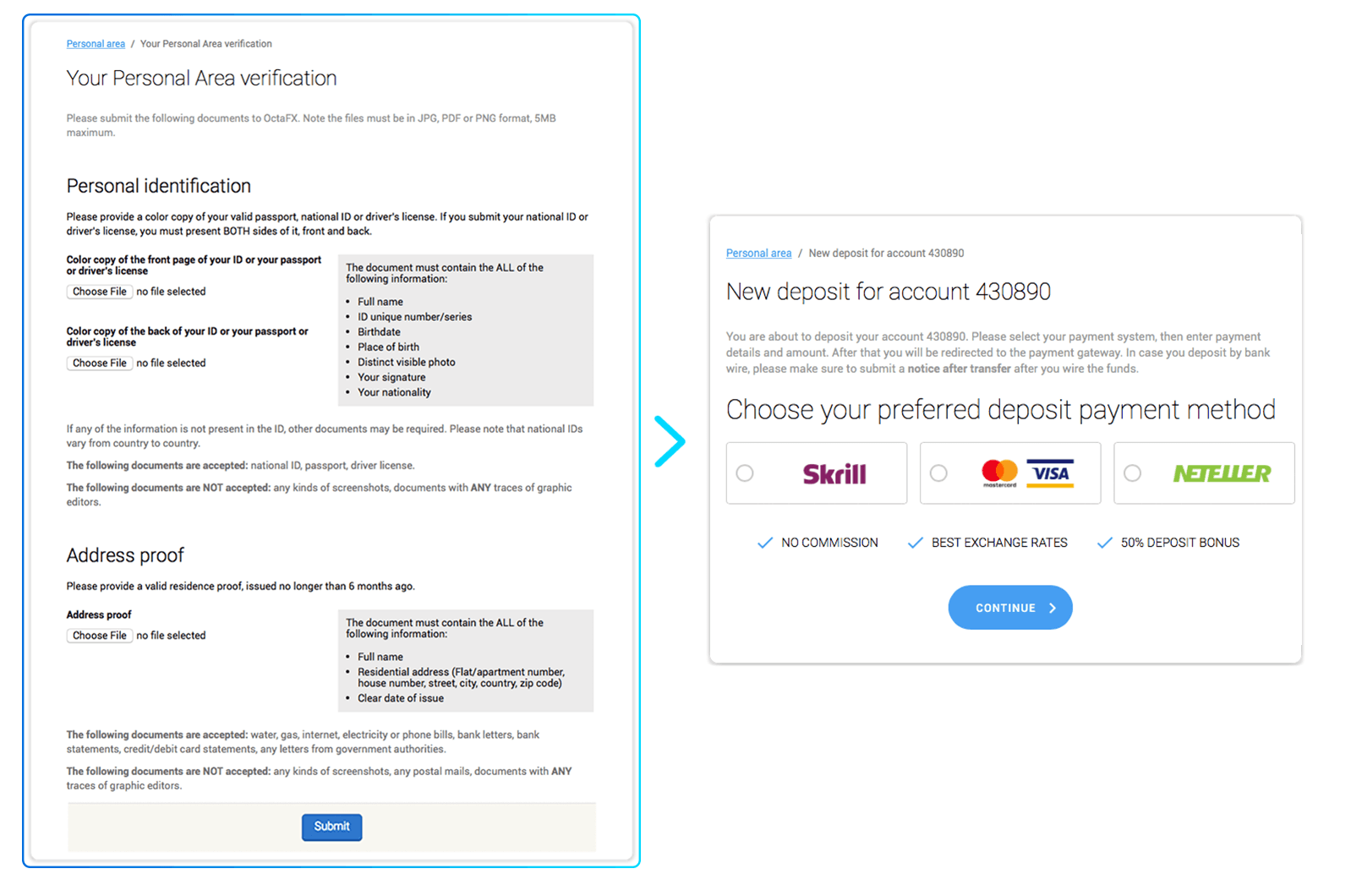

Step 3: Make your first Deposit

Once your email and identity are verified, you can add funds to your trading account. Don’t forget that adding funds allows you to get a 50% deposit bonus and maximise your potential profit.

Step 4: Download the Crypto Trading System

Download the appropriate desktop or mobile MetaTrader app, and sign in with your trading account number, which you have received after the account registration in steps 1 and 2.

Step 5: Add Crypto to The Asset Lists

In order to start trading cryptocurrencies within the MetaTrader systems, you need to add them into the asset list:Desktop: right-click on Market Watch and select Show All

Mobile: press +, select Crypto, and then choose the currencies you want to trade.

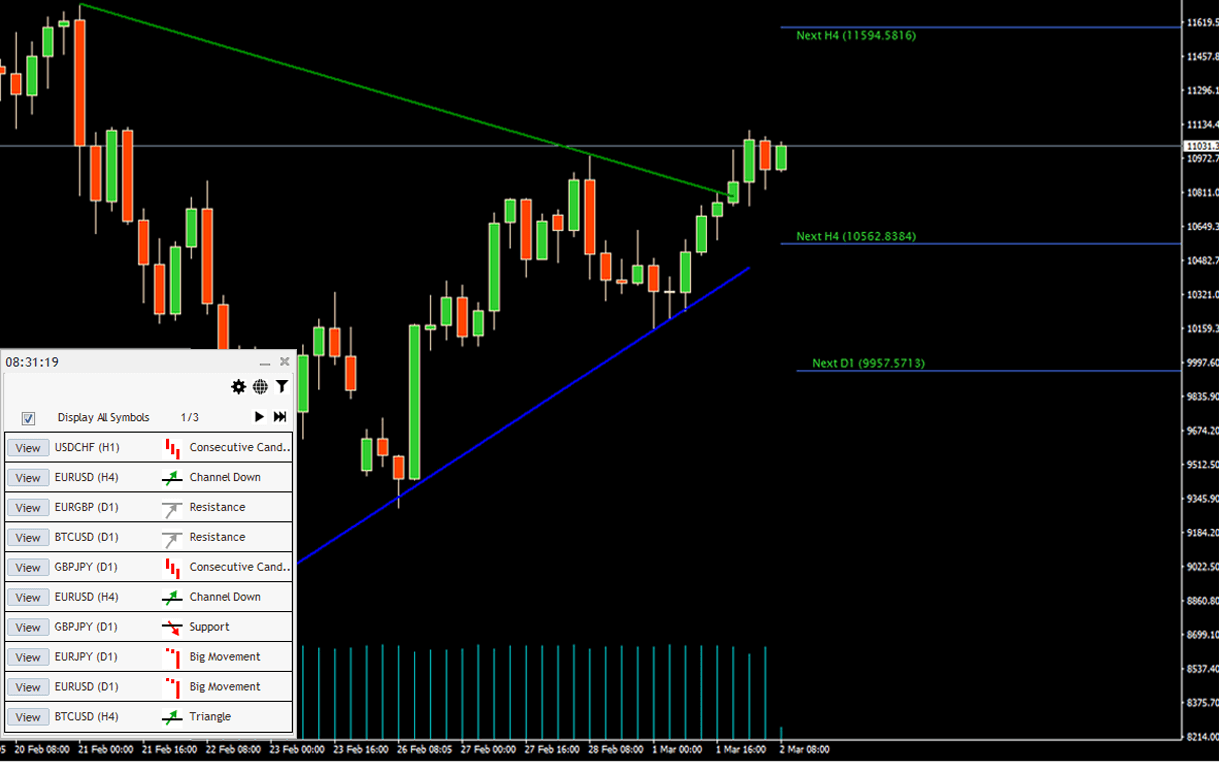

What you need to know about Trading Cryptocurrency

Trading cryptocurrencies doesn’t require any specific knowledge, in fact, it’s not that different from trading Forex, commodity, or other markets. Despite the asset’s unusual nature, the crypto price rises and falls just like any other currency, stock, or commodity. As the crypto market is also affected by predictable external factors, you have the opportunity to make a substantial profit.With us, you can trade Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple. You’ll be able to get our free trading signals plugin that offers detailed technical analysis and some of the best crypto price predictions in the market.

Low Costs and Buying Power

A sensible approach to any sort of investment is to minimise initial outlay while maximising the potential for profit. Our service will set you up well in this regard by offering some of the lowest spreads in the business and the opportunity to trade micro lots as small as 0.01 lot. So you don’t need a huge initial outlay to profit from Bitcoin, Litecoin, Ethereum, Bitcoin Cash, or Ripple.We’ll also provide a free leverage to maximise your profit potential. You can trade with leverage up to 1:25. There are no commissions and deposit or withdrawal fees.

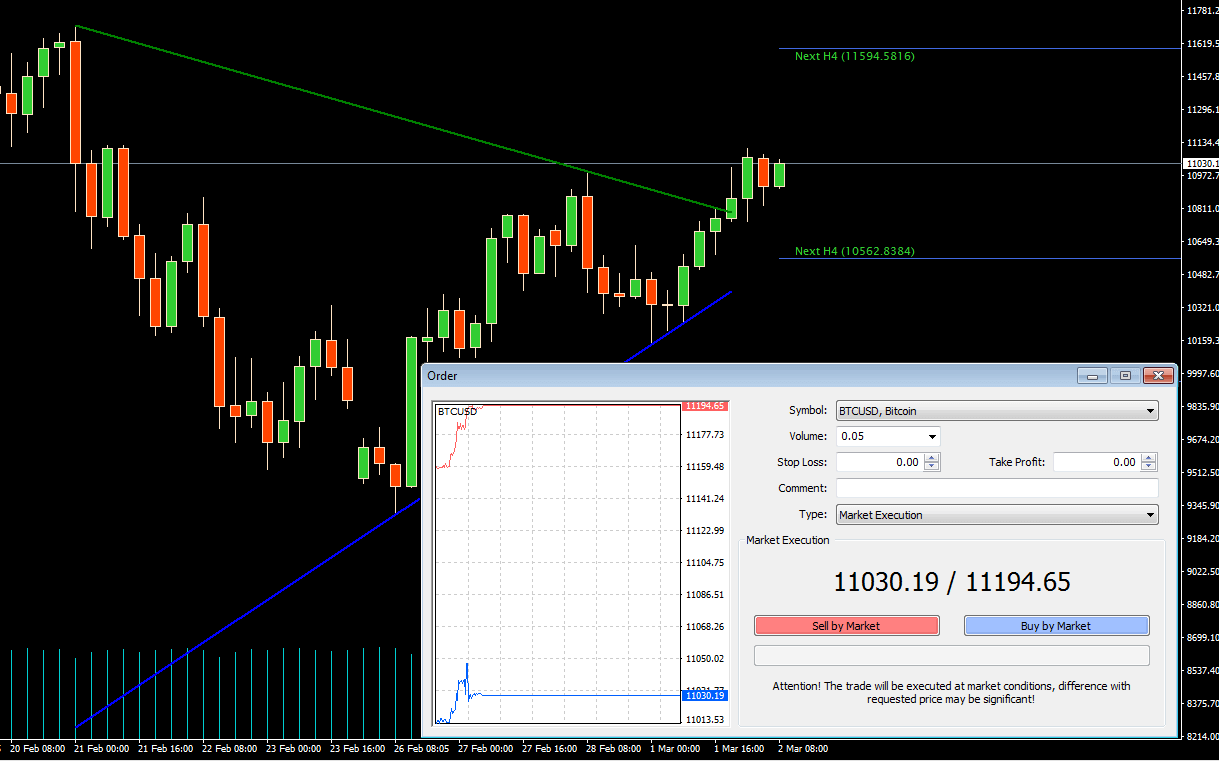

Dont Miss the Perfect Moment

When investing in something as volatile as cryptocurrency, maximising your profit relies on buying and selling with pinpoint accuracy the second the market offers the most potential. We allow you to do this thanks to some of the fastest execution on the market.Buy and sell for the price you see, with no delays, and make deposits and withdrawals instantly.

How to predict the biggest cryptocurrencies’ price

So now that you’re fully briefed on trading cryptocurrencies, it’s time to learn more about the currencies we offer.

Bitcoin

Bitcoin is the first digital currency, created back in 2009. Bitcoin is one of the most volatile and popular instruments among cryptocurrencies.

Bitcoin Cash

Bitcoin Cash, a fork of Bitcoin, is an altcoin that was issued in 2017. Intraday traders usually focus on Bitcoin Cash during the Tokyo and London trade sessions, when it’s most volatile.

Ethereum

Ethereum is a system that supports smart contract technologies to invest in the ICOs of new start-up companies. The more start-ups are interested in Ethereum, the more expensive it becomes. Technical analysis figures work well with Ethereum.

Litecoin

Litecoin was first issued in 2011 and is quite similar to Bitcoin. The Litecoin price greatly depends on Bitcoin. That makes it possible to use the pairs with Bitcoin as the main currency to successfully forecast Litecoin changes.

Ripple

Ripple, often referred to as XRP, was released in 2012 and since then it became one of the largest cryptocurrencies. It demonstrates decent volatility, which attracts many day traders.